September is always an interesting month, not because of the nostalgic memories of the beach and the summer vacation but mainly because it sets the tone for the all important final quarter of the year, the momentum and the expected deal volume to be closed by the end of the year.

Freight rates in September were dominated by an exceptional increase for freight for capesize vessels caused by increased Chinese imports of iron ore. There have been a) no clear documentation yet as to the real cause (whether increased end demand for steel or more innocuously by stockpiling of steel plate or iron ore) and b) whether the trend is sustainable. In a previous posting, we maintained a certain degree of skepticism on this market; however, despite the fact that cape rates increased and pulled upwards the overall dry bulk index (as per chart herebelow), panamax, supramax and handysize vessels didn’t share much of cascading benefit.

The tanker markets, whether crude or products and chemicals, had overall a very un-inspiring summer; clearly chemical tankers and products, especially for clean, performed better; gas tankers also have been showing a more animated performance. The chart herebelow with the two main Baltic Exchange tanker indices does not capture the whole picture, as crude oil tankers in certain markets, and especially VLCCs in particluar, are barely covering vessel daily operating expenses, again.

Despite the very concentrated freight improvement (capes), the overall momentum in the market has been very positive, much more positive than reality justifies, in our opinion. There have been talks that the market has turned, the worst is behind us (including Maersk’s main point during their investor day recently), and that now it’s time to grow by aggressively going after deals. In September, there have been announcements for several secondary offerings in the US (Scorpio, Tsakos, Boxships, etc), the Norwegian over-the-counter market kept maintaining its strong momentum, and several private equity funds and institutional investors – primarily from the US, have started getting more engaged with shipping and actually committing funds. News from a couple of recent trade conferences have been brighter than expected, but it has to be said that the tone at shipping conferences is set by mostly the sell-side and the intermediaries (and as Warren Buffett has already mentioned, you don’t ask your barber whether you need a haircut.)

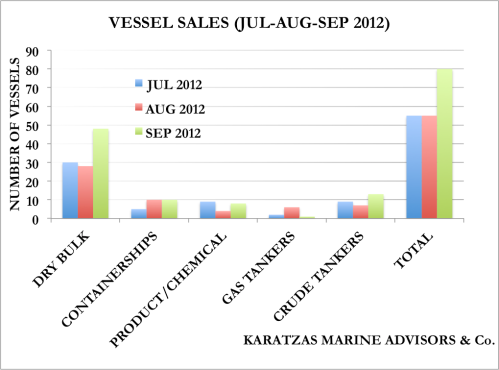

Following on our last monthly report, we have incorporated data from the last three trailing months in 2013 for this end-of-September report, and also for the same timeframe of the last year, in order to give a better perspective; after all, comparing September volumes to August’s is not a fair argument due to seasonality.

We have counted the sale of 84 vessels in the secondary market for dry bulk vessels, containerships, gas tankers, chemical and products, and crude tankers in September 2013. The volume is comparable to that in the previous month (Aug 2013: 90 sales) and also over the last year (Sep 2012: 80 sales.) However, August this year had been unusually busy (90 sales vs only 50 sales in Aug 2012), and the overall result has been that July-Aug-Sept in 2013 were busier for the secondary market with 237 sales vs. 190 sales in the same period last year.

The demolition market for September has been fairly anemic with the sale of 50 vessels which is about 15% lower m-o-m. This is not breaking news, as the ‘de-coupling’ effect of the emerging markets from the Fed’s announcement of tapering off for bond buying had a major casualty in sub-continent currencies and especially for the Indian Rupee (INR), major currency in the demo market, which visited the lowest FX point in about fifteen years. The appointment of MIT-educated, University of Chicago professor Raghuram Rajan as the new Governor of the Reserve Bank of India and his prompt reaction of increasing interest rates as well as the Fed’s decision to temporize the tapering off of the quantitative easing (QE) has brought has stability in the markets and local currencies, and there have been some signs of market improvement by the end of the month.

The de-coupling effect aside, the positive momentum in the freight markets has given second thoughts to many owners pondering whether they should be selling their vintage vessels for scrap. Scrapping prices have improved substantially over the month of September, primarily due to lack of demolition candidate vessels; there are concerns that there has been exuberant speculation in the market and higher expectations for defaults, as ‘cash buyers’ may be bidding up prices, but they are not the end buyers; they take market risk, and a great deal of them do not have the balance sheet to handle such risk, so caveat emptor. In general, scrap prices for tankers in sub-continent have nominally improved from $370/ldt to $420/ldt, an almost 15% increase in a short month, when there are no really assurances that the end market has improved equitably.

The take home message from the demolition market is that in Jul-Aug-Sep 2013, 177 vessels were sold for scrap, vs. 235 vessels that were sold for scrap in the same period year, a decrease in scrapping volume by about 25%. A fairly substantial point, if one is ever to hope for market recovery caused by decreased tonnage capacity.

Further to the market recovery and tonnage capacity, 87 vessels were ordered in September 2013, almost identical amount compared to the month before, but almost 75% improvement y-o-y (50 orders in September 2012.) All in all, in Jul-Aug-Sep 2013, 272 vessels were ordered versus 170 vessels in the same period last year, an improvement of 60%; in terms of net numbers, one hundred more vessels were ordered during than demolished during this period, a monthly average addition of thirty vessels to the world fleet.

Where is that damn market recovery?

For more inspiring thinking, probably a set like in the picture below offers a more promising prospect than chasing shipping statistics…

© 2013 Basil M Karatzas & Karatzas Marine Advisors & Co.

No part of this blog can be reproduced by any means and under any circumstances, whatsoever, in whole or in part, without proper attribution or the consent of the copyright and trademark holders.